Explain How Opportunity Cost Differs From Accounting Cost

Relevant costs are dependent on the decision. A sunk cost is a cost that has already been paid for whereas an opportunity cost is a prospective return that has not yet been earned.

Optimal Decision Making And Opportunity Costs Video Khan Academy

The loss of existing profits will occur only if customers order is accepted.

. It is a potential benefit or income that is given up as a result of selecting an alternative over another. The concept is somewhat the same in economics as well as accounting. Let us look at how economic costs can differ from accounting costs in the treatment.

The concept of opportunity cost is applied in various management accounting areas including. The opportunity cost attempts to quantify the impact of choosing one investment over another. On the other hand financial accounting helps us.

What is the opportunity cost. The major difference between sunk cost and opportunity cost is that when the organizations are making important strategic decisions for their future sunk cost must not be considered as it incurred in the past and cannot be recovered. Explain what condition must hold for a firm to minimize its production cost.

For example a business pays 50000 to acquire a piece of custom machinery. Opportunity cost is also named as implied or implicit cost. Theres no such thing as a free-lunch.

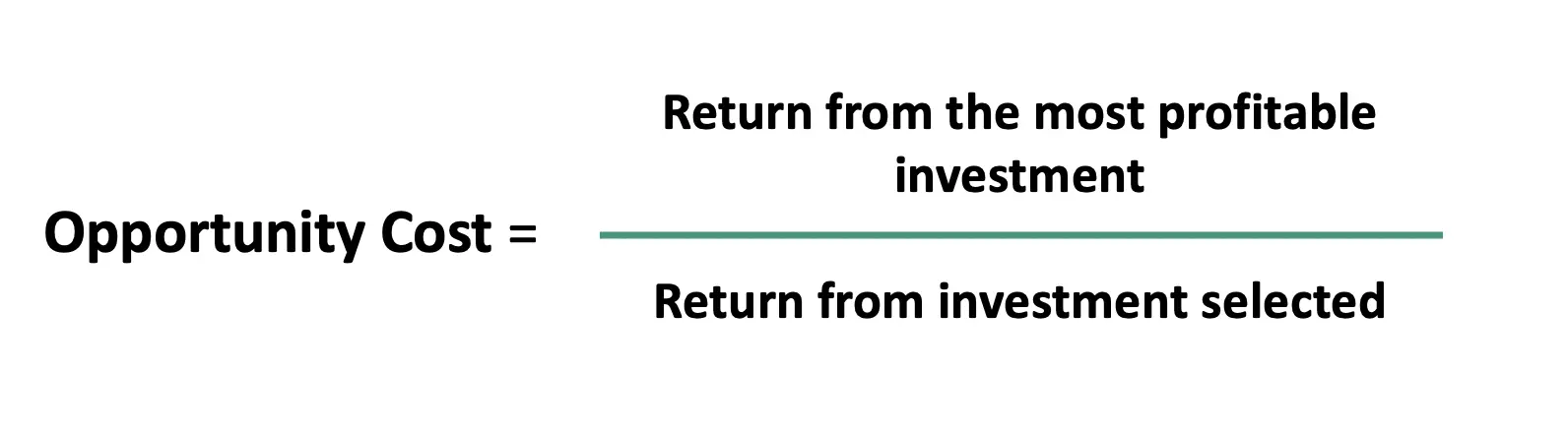

Relevant costs consists of actual cash flows. If you could have spent the money on a different investment that would have generated a return of 7 then the 2 difference between the two alternatives is the foregone opportunity cost of this decision. The opportunity cost of capital is the difference between the returns on the two projects.

Cost accounting tells us the expenses of each unit of each product. This is a sunk cost. You can calculate accounting cost by subtracting your expenses from your.

Opportunity Cost is not a type of cost that is ordinarily captured in the accounting system such as payroll cost and overheads. 3 rows Accounting Cost. Explicit costs involve opportunity cost as well.

Direct indirect fixed and variable are the 4 main kinds of cost. So what you decide to do with your time is. Opportunity cost is defined as the worth of a missed alternative opportunity in accounting also.

Opportunity cost is the comparison of one economic choice to the next best choice. The key difference between the two is that an opportunity cost is a foregone choice for a future event. When youre calculating the cost of going to college your accounting costs are 80000 but your opportunity cost is 120000.

Company receives cash by selling its product and if production is halted this cash flow will also stop. Economic costs include accounting costs and implicit costs. A pool of activity costs associated with particular processes and used in activity-based costing ABC systems.

The Balance Maddy Price. The formula for calculating an opportunity cost is simply the difference between the expected returns of each option. For example You have a job in a company that pays you 25000 per year.

Accounting costs refer to the costs recorded in. Remember economic costs include accounting costs plus opportunity. Using the previous example with the college student if the college student gave up a 20000-a-year job to go to.

These comparisons often arise in finance and economics when trying to decide between investment options. The senior management of a business expects to earn 8 on a long-term 10000000 investment in a new manufacturing facility or it can invest the cash in stocks for which the expected long-term return is 12. Explain the difference between economies of scale and economies of scope.

Rather they involve opportunities to earn money that are abandoned in a financial decision. Howeverthe opportunity cost would be useful in deciding the best option that must be selected in making important decisions. Meaning if you were invited to a free lunch you still are forgoing an opportunity to do some other activity during that same time.

Answer 1 of 4. Thus a sunk cost is backward looking while an opportunity cost is forward looking. Despite all the complexities cost accounting can largely be broken into fixed and variable costs.

Opportunity cost is the profit lost when one alternative is selected over another. For example if a company sells three products product A product B and product C. The other costs can be fit into either the fixed or variable categories.

What is the expansion path. Example of the Opportunity Cost of Capital. For example wages are the opportunity costs for labour inputs purchased in a competitive market.

It may therefore force organizations to look at the bigger picture when evaluating business decisions. The total of the accounting costs plus the differences in costs between choosing the other options instead of option A is the economic cost. In addition to this you might also want to look into operating costs opportunity costs sunk costs and.

What is the difference between the opportunity cost and the accounting cost. These costs are relevant for the economists because the costs of wages and materials represent money that could have been usefully spent elsewhere. Unlike other types of cost opportunity cost does not require the payment of cash or its equivalent.

Another example is if a company has an asset an orange grove for example and uses an economic cost analysis to determine. Cost accounting helps us determine how much material labor etc are expended in each unit of product A product B and product C. When you invest opportunity cost can be defined as.

Whereas the sunk cost is an already incurred cost for a past event. The only difference is that the concept of opportunity cost in accounting gives more focus on the calculation or quantitative part. What is opportunity costs in accounting.

Opportunity cost is the value of what you lose when you choose from two or more alternatives. Implicit costs also known as opportunity costs do not involve spending money. Economic costs include both the explicit and implicit costs of an action.

Another key difference between the two is that an opportunity cost is uncertain. Accounting costs represent anything your business has paid for. Why can one be present without the.

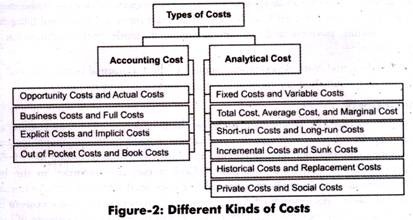

Types Of Cost Accounting Cost And Analytical Cost With Diagram

Differences Between Cost Accounting And Financial Accounting Cost Accounting Financial Accounting Accounting

Comments

Post a Comment